Stock Market

Introduction

Investing in the stock market can be a daunting task, especially for beginners. Navigating the complexities of market trends, understanding financial jargon, and making informed decisions require a solid foundation of knowledge. This is where stock market guides come into play.

Stock market guides serve as valuable resources, providing step-by-step instructions, insights, and strategies to help both novice and experienced investors make informed choices. In this blog post, we will explore various stock market guides, comparing them across different criteria to help you find the one that best suits your needs.

Whether you are just starting your investment journey or looking to deepen your understanding of market dynamics, having the right guide can significantly impact your success. Our comprehensive comparison will cover aspects such as the depth of content, author expertise, ease of understanding, and more, ensuring you have all the information needed to make a smart choice.

Images could be added in the following places to enhance the introduction:

- Near the beginning: An image of a stock market chart or an investor reading a guidebook to visually represent the topic.

- Mid-section: A graphic illustrating the benefits of using stock market guides.

- Towards the end: A comparison table or a collage of different popular stock market guide covers to give readers a visual preview of what’s to come in the post.

What to Look for in a Stock Market Guide

Choosing the right stock market guide can make a significant difference in your investment journey. With so many options available, it’s essential to know what to look for to ensure you select a guide that meets your needs and enhances your understanding of the stock market. Here are key factors to consider:

- Comprehensive Coverage of Topics A good stock market guide should cover a wide range of topics, from basic concepts to advanced strategies. Look for guides that explain fundamental and technical analysis, portfolio management, risk management, and market psychology.

- Author Expertise and Credibility The credibility of the author is crucial. Check the author’s background, qualifications, and experience in the financial industry. Guides written by recognized experts or successful investors often provide more reliable and insightful information.

- Ease of Understanding and Accessibility Investing can be complex, so the guide you choose should be easy to understand. Look for guides that break down complicated concepts into simple, digestible explanations. Clear language, practical examples, and straightforward instructions are essential.

- Updated Information The stock market is constantly evolving. Ensure the guide you select is up-to-date with the latest market trends, regulations, and investment strategies. Guides that are regularly updated or have recent editions are more likely to provide relevant information.

- Practical Examples and Case Studies Practical examples and case studies help illustrate theoretical concepts and show how they apply in real-world scenarios. Look for guides that include these elements to enhance your learning experience and provide a practical understanding of the market.

- Interactive Elements and Supplementary Materials Some stock market guides offer interactive elements such as quizzes, exercises, and online resources. These can be very beneficial for reinforcing learning and testing your understanding. Supplementary materials like videos, webinars, and additional readings can also add value.

By considering these factors, you can select a stock market guide that not only educates you but also equips you with the tools and knowledge needed to succeed in your investment journey.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic highlighting key factors to look for in a stock market guide.

- Mid-section: Screenshots or images of highly recommended stock market guides, showcasing their covers or sample pages.

- Towards the end: A flowchart or checklist summarizing the criteria for choosing a good stock market guide.

Comprehensive Coverage of Topics

When selecting a stock market guide, one of the most important factors to consider is the comprehensiveness of its topic coverage. A guide that provides thorough and detailed information on a wide range of subjects is invaluable for both beginners and experienced investors. Here are the key topics that a comprehensive stock market guide should cover:

- Introduction to the Stock Market

- Basic concepts and terminology.

- Overview of how the stock market operates.

- Types of stocks and stock exchanges.

- Fundamental Analysis

- Understanding financial statements (balance sheet, income statement, cash flow statement).

- Key financial ratios and what they indicate.

- Evaluating a company’s intrinsic value.

- Technical Analysis

- Chart patterns and technical indicators.

- Trends, support and resistance levels.

- Using technical analysis to make trading decisions.

- Investment Strategies

- Long-term vs. short-term investment strategies.

- Value investing, growth investing, and dividend investing.

- Risk management techniques.

- Portfolio Management

- Diversification and asset allocation.

- Rebalancing your portfolio.

- Strategies for different investment goals (retirement, education, etc.).

- Market Psychology

- Behavioral finance principles.

- Understanding market sentiment and investor behavior.

- Strategies to manage emotions in investing.

- Risk Management

- Identifying and assessing risks.

- Techniques to mitigate and manage risk.

- Importance of having a risk management plan.

- Global Markets and Economic Indicators

- Impact of global events on the stock market.

- Key economic indicators to watch (GDP, inflation, interest rates).

- Understanding the interconnection between global markets.

- Regulations and Taxation

- Overview of stock market regulations.

- Tax implications of investing.

- Strategies to optimize tax efficiency.

A stock market guide that covers these topics comprehensively will provide you with a solid foundation of knowledge, helping you make informed investment decisions and navigate the complexities of the stock market.

Images could be added in the following places to enhance this section:

- Near the beginning: A visual representation of the stock market ecosystem, including exchanges, types of stocks, and market participants.

- Mid-section: Diagrams or charts illustrating key concepts in fundamental and technical analysis, such as financial ratios, chart patterns, and indicators.

- Towards the end: A summary infographic or table listing the essential topics covered in a comprehensive stock market guide.

Author Expertise and Credibility

When choosing a stock market guide, the expertise and credibility of the author are crucial factors to consider. A guide written by a knowledgeable and experienced author is more likely to provide accurate, reliable, and insightful information. Here are some key points to look for when assessing an author’s expertise and credibility:

- Professional Background

- The author’s professional experience in finance or investment. Look for authors with careers as financial analysts, portfolio managers, or investment advisors.

- Any notable positions held within reputable financial institutions or organizations.

- Educational Qualifications

- The author’s educational background in finance, economics, or related fields.

- Advanced degrees such as MBAs or CFAs (Chartered Financial Analyst) that demonstrate a higher level of expertise.

- Industry Recognition

- Awards, honors, or recognitions received by the author within the finance industry.

- Inclusion in prestigious lists or publications, such as top financial advisors or influential investors.

- Published Works

- Other books, articles, or research papers published by the author.

- Contributions to well-known financial magazines, journals, or websites.

- Practical Experience

- Real-world experience in investing or trading. Authors who have successfully navigated the stock market themselves bring valuable practical insights.

- Any case studies or examples provided in the guide that demonstrate the author’s applied knowledge.

- Reputation and Reviews

- Feedback and reviews from other readers and experts in the field.

- The author’s reputation within the investment community. Positive testimonials and endorsements can be a good indicator of credibility.

By considering these factors, you can assess whether the author of a stock market guide has the necessary expertise and credibility to provide valuable guidance. A well-qualified author not only enhances the quality of the guide but also boosts your confidence in the information presented.

Images could be added in the following places to enhance this section:

- Near the beginning: A professional headshot or image of the author, along with a brief bio.

- Mid-section: Infographics or charts summarizing the author’s qualifications, experience, and recognitions.

- Towards the end: Screenshots or images of other works published by the author, showcasing their breadth of knowledge and contributions to the field.

Ease of Understanding and Accessibility

A stock market guide should be easy to understand and accessible to readers of all levels. Whether you’re a beginner just starting out or an experienced investor looking to refine your strategies, the guide should present information clearly and concisely. Here are some key aspects to look for:

- Clear Language and Explanations

- The guide should use simple, straightforward language.

- Avoidance of unnecessary jargon or technical terms without explanations.

- Concepts should be broken down into easily digestible parts.

- Logical Structure and Organization

- The content should be well-organized, with a logical flow from one topic to the next.

- Use of headings, subheadings, and bullet points to break up text and make information easier to find.

- Inclusion of summaries or key takeaways at the end of each section to reinforce learning.

- Visual Aids and Illustrations

- Diagrams, charts, and infographics can help illustrate complex concepts.

- Screenshots of trading platforms or tools to provide practical guidance.

- Visual aids can make the content more engaging and easier to understand.

- Practical Examples and Case Studies

- Real-world examples that apply theoretical concepts to actual scenarios.

- Case studies that show how successful investors have implemented strategies.

- Step-by-step walkthroughs of common processes, such as evaluating a stock or making a trade.

- Interactive Elements

- Quizzes and exercises to test your understanding and reinforce learning.

- Access to supplementary materials, such as videos, webinars, or online forums for further discussion and support.

- Interactive elements can enhance the learning experience and provide practical application.

- Accessibility Features

- Availability in multiple formats, such as print, digital, and audiobook.

- Consideration of accessibility needs, such as large print versions or screen reader compatibility.

- Guides that cater to different learning preferences and needs are more inclusive and user-friendly.

By prioritizing ease of understanding and accessibility, a stock market guide can ensure that it is useful and beneficial to a wide range of readers. This approach not only makes the guide more appealing but also enhances its effectiveness in imparting valuable knowledge.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic highlighting the importance of clear and accessible financial education.

- Mid-section: Examples of visual aids, such as charts, diagrams, or screenshots from the guide.

- Towards the end: A comparison table or checklist of accessibility features and interactive elements included in the guide.

Updated Information

In the fast-paced world of investing, staying current is crucial. A stock market guide that provides updated information ensures you are equipped with the latest insights, strategies, and data. Here are key reasons why updated information in a stock market guide is essential:

- Relevance to Current Market Conditions

- The stock market is influenced by numerous factors, including economic conditions, geopolitical events, and technological advancements.

- A guide with updated information reflects the latest market trends and developments, providing you with relevant advice and strategies.

- Accuracy of Data and Examples

- Financial data and market examples can quickly become outdated.

- Updated guides include the most recent statistics, case studies, and examples, making the content more accurate and reliable.

- Compliance with Current Regulations

- The financial industry is subject to changing regulations and policies.

- A guide that incorporates updated regulatory information ensures you are aware of the latest legal requirements and compliance standards.

- Inclusion of New Investment Strategies

- Investment strategies evolve over time as new techniques and tools are developed.

- An updated guide introduces you to contemporary strategies and approaches that can enhance your investment performance.

- Adapting to Technological Advancements

- Technology plays a significant role in modern investing, from trading platforms to analytical tools.

- Guides that cover the latest technological advancements help you stay competitive and make the most of new resources.

- Responsive to Market Volatility

- The stock market can be volatile, with rapid changes occurring within short periods.

- A guide that is frequently updated can offer timely advice on how to navigate market volatility and adjust your investment strategy accordingly.

Selecting a stock market guide that prioritizes updated information ensures that you are learning from the most current and relevant content. This not only improves your understanding of the market but also enhances your ability to make informed and strategic investment decisions.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic showing the importance of staying current in the stock market.

- Mid-section: Screenshots or images of the latest market data, charts, or regulatory updates included in the guide.

- Towards the end: A timeline or comparison chart showing updates made to the guide over time.

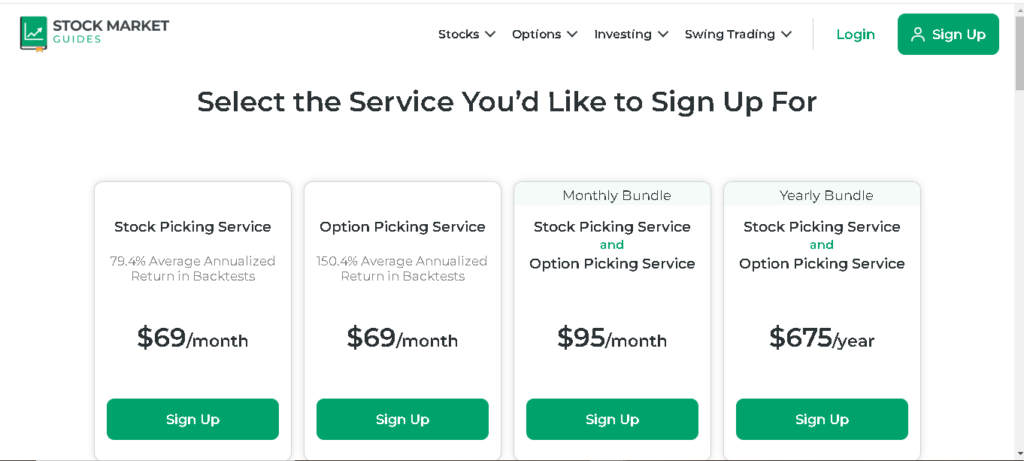

Price and Value for Money

When selecting a stock market guide, evaluating the price and value for money is crucial. While some guides may come with a higher price tag, it’s important to consider the value they offer in terms of content, expertise, and additional resources. Here are some factors to consider when assessing the price and value for money of a stock market guide:

- Content Quality and Depth

- The comprehensiveness and depth of the content provided in the guide.

- High-quality guides often justify their price through detailed explanations, practical examples, and thorough coverage of essential topics.

- Author Expertise and Credibility

- Guides authored by well-known experts or seasoned investors may come at a premium but offer valuable insights and reliable information.

- Assess the author’s background, qualifications, and reputation in the finance industry.

- Additional Resources and Tools

- Some guides include supplementary materials such as workbooks, online resources, or access to exclusive webinars.

- Interactive elements like quizzes, exercises, and real-world case studies can enhance the learning experience and add value.

- Updates and Revisions

- Guides that are regularly updated to reflect the latest market trends, regulations, and investment strategies can offer better value.

- Check if the purchase includes future updates or if new editions need to be bought separately.

- Reader Reviews and Testimonials

- Feedback from other readers can provide insight into the guide’s value for money.

- Look for reviews that mention the guide’s practical usefulness, comprehensiveness, and how it helped improve their investing knowledge.

- Cost Comparison

- Compare the prices of different stock market guides within the same category or with similar features.

- Consider both the upfront cost and any ongoing expenses, such as subscription fees for online resources.

- Return on Investment

- A well-chosen guide can provide a significant return on investment by enhancing your understanding of the stock market and improving your investment decisions.

- Think of the guide as an investment in your financial education and future success.

By carefully evaluating these factors, you can determine whether a stock market guide offers good value for money. Investing in a high-quality guide can pay off in the long run by equipping you with the knowledge and tools needed to succeed in the stock market.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic showing the correlation between price and value in educational materials.

- Mid-section: Screenshots or images of additional resources included with the guide, such as workbooks or online access.

- Towards the end: A comparison table showing different stock market guides, their prices, and key features.

Reviews and Testimonials

When choosing a stock market guide, reviews and testimonials from other readers can provide valuable insights into the guide’s effectiveness and value. They offer real-world feedback on the guide’s content, usability, and overall impact. Here are some key points to consider when looking at reviews and testimonials for stock market guides:

- Content Quality and Clarity

- Look for reviews that highlight the clarity and comprehensiveness of the guide’s content.

- Positive feedback about easy-to-understand explanations, practical examples, and well-structured content can indicate a high-quality guide.

- Effectiveness and Practicality

- Testimonials that mention how the guide has helped readers improve their investing skills or achieve better investment results are particularly valuable.

- Practical examples and case studies mentioned in reviews can indicate the guide’s applicability to real-world scenarios.

- Author Credibility

- Reviews often reflect on the author’s expertise and credibility.

- Positive comments about the author’s background, experience, and ability to explain complex concepts can enhance the guide’s reliability.

- Ease of Use

- Feedback on the guide’s layout, structure, and accessibility can help you understand how user-friendly it is.

- Reviews that mention well-organized chapters, useful summaries, and helpful visual aids are good indicators of a reader-friendly guide.

- Additional Resources

- Testimonials that discuss the value of supplementary materials, such as workbooks, online resources, and interactive elements, can highlight added benefits.

- Positive reviews about these additional resources can suggest a more comprehensive learning experience.

- Value for Money

- Reviews that assess whether the guide provides good value for its price are important.

- Look for comments on the balance between cost and the benefits received, such as the quality of content and additional resources.

- Reader Satisfaction

- Overall satisfaction ratings and positive testimonials can be strong indicators of a well-received guide.

- Look for recurring themes in reviews, such as improved confidence in investing, better understanding of the market, and overall satisfaction with the purchase.

By considering these factors, you can gain a better understanding of the strengths and weaknesses of different stock market guides. Reviews and testimonials provide a glimpse into the experiences of other readers, helping you make an informed decision.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic showing the importance of reviews and testimonials in selecting educational materials.

- Mid-section: Screenshots or images of sample reviews and testimonials from popular stock market guides.

- Towards the end: A visual summary or chart of overall satisfaction ratings for different guides.

Comparison of Top Stock Market Guides

When deciding on a stock market guide, comparing the top options can help you identify the best fit for your investing goals and learning style. Here’s a detailed comparison of key features to consider:

- Comprehensive Coverage

- Compare the breadth and depth of topics covered in each guide.

- Look for guides that address fundamental and advanced concepts in investing, financial analysis, and portfolio management.

- Author Expertise

- Assess the qualifications and experience of the guide’s authors.

- Consider guides authored by recognized experts or experienced investors in the finance industry.

- Clarity and Ease of Understanding

- Evaluate how well each guide explains complex concepts.

- Look for clear language, practical examples, and effective use of visual aids to enhance understanding.

- Updated Information

- Check how frequently each guide is updated to reflect current market trends and regulations.

- Guides that incorporate the latest data and strategies provide more relevant and accurate information.

- Additional Resources

- Compare the availability of supplementary materials such as workbooks, online resources, and interactive tools.

- Assess the value added by these resources in enhancing the learning experience.

- User Reviews and Testimonials

- Consider feedback from other readers and investors about their experiences with each guide.

- Look for testimonials that highlight the guide’s strengths and any areas for improvement.

- Value for Money

- Evaluate the cost of each guide relative to the content and resources provided.

- Consider the overall value in terms of knowledge gained and investment potential.

- Format and Accessibility

- Compare the availability of guides in different formats, such as print, digital, or audiobook.

- Consider which format best suits your preferences and learning style.

- Support and Community

- Assess the availability of customer support, forums, or communities associated with each guide.

- Consider the importance of ongoing support and interaction with other learners.

- Recommendations

- Based on your evaluation, make recommendations for different types of investors (beginners, advanced, specific investment goals).

By comparing these factors across top stock market guides, you can make an informed decision that aligns with your investment objectives and educational needs.

Images could be added in the following places to enhance this section:

- Near the beginning: A visual comparison chart highlighting key features of each guide.

- Mid-section: Screenshots or images of the covers of the top recommended stock market guides.

- Towards the end: Infographics or tables summarizing the comparison results for easy reference.

Availability in Various Formats

The availability of a stock market guide in various formats can significantly impact its accessibility and usability for different types of learners. Here’s why considering format availability is important when choosing a guide:

- Print Format

- Guides available in print format are ideal for readers who prefer physical copies.

- Printed books offer portability and the ability to annotate and highlight important sections.

- Digital Format

- Digital guides are accessible on e-readers, tablets, and smartphones, providing flexibility in where and how you read.

- They often include interactive features such as clickable links, search functions, and multimedia content.

- Audiobook Format

- Audiobooks cater to auditory learners who prefer listening over reading.

- They are convenient for listening while commuting, exercising, or multitasking.

- Online Courses and Webinars

- Some guides are offered as part of online courses or include access to webinars.

- These formats provide a more interactive learning experience with video lectures, quizzes, and community forums.

- Subscription Services

- Subscription-based services offer access to a library of guides and resources for a recurring fee.

- They provide ongoing updates and additional content, enhancing the value over time.

- Compatibility and Accessibility

- Consider the compatibility of each format with your devices and preferences.

- Accessibility features, such as large print options or compatibility with screen readers, are essential for inclusive learning experiences.

- Cost and Value

- Compare the costs associated with each format, including any subscription fees or additional purchases.

- Evaluate the value provided by each format in terms of convenience, usability, and additional resources.

Choosing a guide available in multiple formats ensures you can select the option that best suits your learning style and preferences. Whether you prefer the tactile experience of a physical book, the flexibility of digital formats, or the convenience of audiobooks and online courses, format availability enhances accessibility and enriches your learning experience.

Images could be added in the following places to enhance this section:

- Near the beginning: An infographic illustrating the benefits of different formats (print, digital, audiobook, online courses).

- Mid-section: Screenshots or images of each format (e.g., book covers, digital devices, audiobook platforms).

- Towards the end: A comparison table summarizing the features and availability of each format for stock market guides.